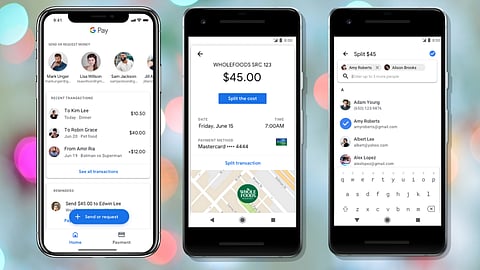

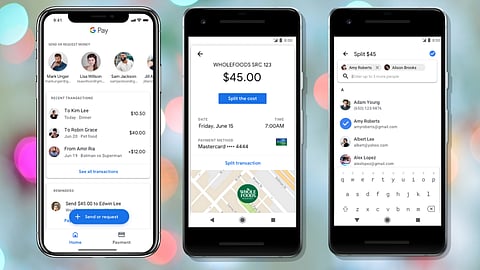

Google has introduced several features in its Pay feature for both Android and iOS users which have been first rolled out in the US.

The new Google Pay app is designed around relationships with people and businesses.

"It helps you save money and gives you insights into your spending. It's built with multiple layers of security to keep your money and information private and safe. And in 2021, it will give you the chance to apply for a new kind of digital bank account with trusted financial institutions," said Caesar Sengupta, General Manager and VP, Payments and Next Billion Users.

The company said in a statement on Wednesday it is working with trusted financial institutions to create Plex, a new mobile-first bank account integrated into Google Pay.

"Plex Accounts are offered by banks and credit unions, include checking and savings accounts with no monthly fees, overdraft charges or minimum balance requirements and help you save toward your goals more easily".

The new Google Pay app focuses on the friends and businesses you transact with most frequently.

"You can pay, see past transactions and find offers and loyalty infoeall organized around conversations".

Google Pay can also help you save money and redeem offers without the hassle of clipping coupons or copying and pasting promo codes.

"If you choose to connect your bank account or cards to Google Pay, the app will provide periodic spending summaries and show your trends and insights over time, giving you a clearer view of your finances," said Sengupta.

Google Pay can now understand and automatically organize your spending.

"Google Pay alerts you when you might be paying a stranger, protects you with advanced security, and gives you transparency and control to choose the privacy settings that are right for you. You can change these settings at any time", the company said.

Starting in 2021,e11 banks and credit unions, including minority-owned depository banks, in the U.S. will start offering Plex Accounts in Google Pay.